By Dr. Andrew Jones, PhD

If you are confused by terminology used in the carbon market, you are not alone.

Interest in Carbon Dioxide Removal (CDR) has risen exponentially in recent years. This has resulted in a whole world of industry jargon that makes this already complicated market even more complex to understand. To make matters worse, a lot of the terminology is often very loosely defined. Several attempts have been made to explain the carbon market terminology, here are a few good ones:

Carbon Plan’s CDR Primer

Carbon Offset Guide’s Understanding Carbon Offsets

Cool Effect’s The Lifecycle of a Carbon Offset

However, given the dynamic nature of this market, we need to constantly update and refine the description of each term. In this article, we’ll review and explain the most important terminologies used in compliance and voluntary carbon markets.

The Basics

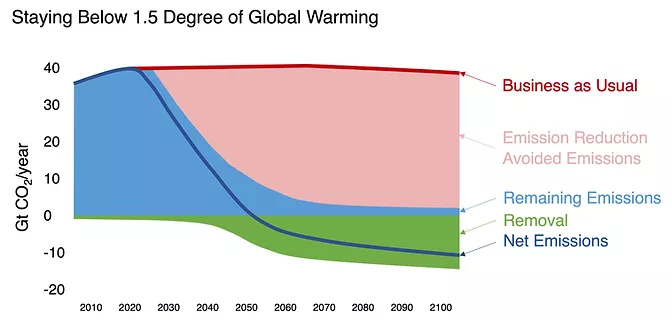

As we explained in our previous post, everything starts with Figure 1 below. It’s the world’s plan to reduce and then remove Carbon Dioxide (CO2) from the atmosphere to lower its concentration and thus limit global temperature rise.

Figure 1: Emission reduction and removal pathway to stay below 1.5oC global warming

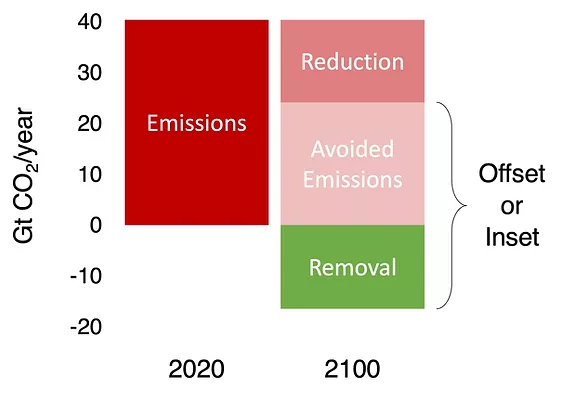

The figure above packs a lot of information that is often overlooked. Let’s simplify Figure 1 and look at it only in two snapshots, now and then in the year 2100.

Figure 2: Current emissions and desired emissions in the year 2100

The world emits about 40 Giga Tons (GTons) of CO2 each year. By the year 2100, that number needs to be somewhere between -10 to -20 GTons of CO2 per year. That transition will happen through three mechanisms, Emission Reduction, Avoided Emissions, and Carbon Dioxide Removal (CDR). Avoided Emissions and CDR are also referred to as either offsets or insets. Let’s explain what each of those means.

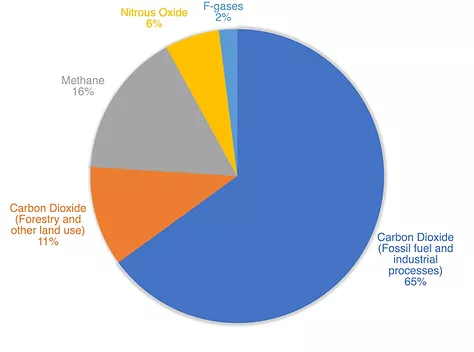

Emissions

Release of Greenhouse Gases (GHG) into the atmosphere due to human activity mainly through burning fossil fuels, but also activities such as agricultural tilling, deforestation, and natural forest fires. Global GHG emissions are dominated by CO2 but also include Methane (CH4), Nitrous Oxide (N2O), and Fluorinated gases (F-gases). Figure 3 shows the breakdown of global GHG emissions.

Figure 3: Global GHG emissions by gas (Data source: IPCC 2014)

Global Warming Potential (CO2 vs. CO2-e)

Each gas has a different impact on the climate. They differ in their ability to absorb energy (Radiative Efficiency) and their residence time in the atmosphere (Lifetime). Those differences are captured in a metric called “Global Warming Potential (GWP)”. GWP is a measure of how much energy the emission of 1 ton of a gas will absorb over a given period of time, relative to the emission of one ton of CO2. GHG emissions are often reported in CO2 equivalent or CO2-e in order to capture the effects of all GHG gases in one number. CO2-e means the number of metric tons of CO2 emissions with the same global warming potential as one metric ton of another greenhouse gas (See here for detailed equation). Table 1 summarizes the major GHGs and their respective GWPs. Note that all other GHGs have higher heat-trapping ability compared to CO2.

Emission Scopes

Depending on where the emission is being accounted for, emissions are grouped into three categories or scopes. According to the GHG Protocol Corporate Standard, Scope 1 emissions are direct emissions from owned or controlled sources. Scope 2 emissions are indirect emissions from the generation of purchased energy (mainly electricity, also purchased heat or steam). Scope 3 emissions are all indirect emissions (not included in scopes 1 and 2) that occur in the value chain of the reporting company, including both upstream and downstream emissions.

Emission Reduction

Emission reductions are quantifiable reductions in the release of GHGs. Emission reductions are measured in metric tons of CO2-e and are associated with a specific activity, over a specific area, and a specific period of time. Fuel switching from hydrocarbon sources of energy to carbon-free sources of energy such as wind and solar is the most common type of emission reduction. Transitioning to no-till and reducing the use of chemical fertilizers on farms are also other examples of emission reduction.

Avoided Emissions

Avoided emissions are emissions that would have occurred if certain measures were not taken. Sourcing deforestation-free palm oil or cocoa is one example of avoided emissions. Other examples of products (goods and services) that avoid emissions include low-temperature detergents, fuel-saving tires, energy-efficient ball-bearings, and teleconferencing services.

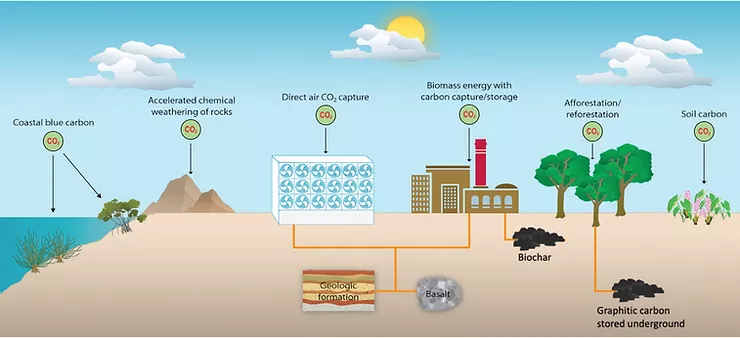

Carbon Dioxide Removal

As explained in detail in our previous post, CDR is the umbrella term that refers to all existing pathways and technologies that removes carbon from the atmospheric pool and store it in other planetary carbon pools. Figure 4 shows an overview of most common CDR technologies including Carba’s newly developed Underground Graphitic Carbon Storage.

Figure 4: Current CDR technologies

CDR is an important tool for addressing emissions from the hardest to decarbonize sectors —like agriculture and transportation—and to eventually remove legacy CO2 emissions from the atmosphere. It is important to note that CDR should come after we have exhausted all avoided emissions and emission reduction opportunities.

[Carbon] Offset

Any activity that results in emission reduction or CDR. Offsets need to be quantifiable and meet certain criteria such as additionality and permanence. Offsets can be traded in either voluntary or compliance carbon markets, with each having its own programs, policies, and requirements. Terms like additionality, permanence, voluntary, and compliance markets are explained later in this article.

[Carbon] Inset

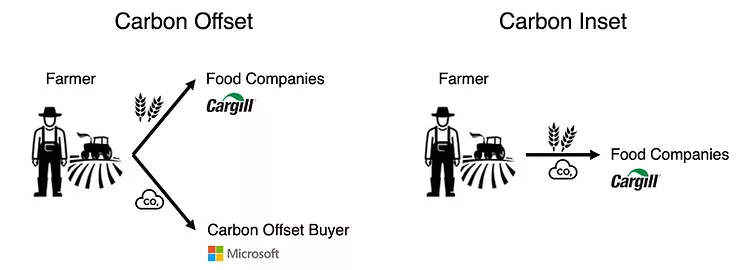

Inset is a type of offset that happens within a company’s own value chain. In contrast to a typical carbon offset project, emissions are avoided, reduced, or sequestered upstream or downstream within the company's own value chain. Figure 5 below highlights the difference between an offset and an in

Figure 5: Difference between a carbon offset and an inset (Original Image: ClimateTech VC)

[Carbon Offset] Credit

Although the terms offset and offset credit are often used interchangeably, they mean slightly different things. An offset refers to the act of reducing carbon emissions or removing CO2 from the atmosphere. An offset credit is a transferable instrument that is created after an offset happens. A carbon offset credit is certified by governments or independent certification bodies to represent an emission reduction of one metric tonne of CO2-e.

The [Carbon] Market

In order to successfully achieve the carbon reduction and removal goals, we need a well-established market to govern that process. Given the nascent nature of this topic, a lot of the details are still being ironed out. But in general, carbon is traded under two markets: “Compliance” and “Voluntary” markets.

Compliance markets

Compliance offsets are used to meet legally binding caps on carbon in schemes like the European Union’s Emissions Trading System or the California Cap and Trade. In such a scheme large emitters are subject to an emission cap. However, those emitters are allowed to exceed their cap as long as they source approved carbon offsets. Compliance markets often use more rigorous carbon accounting protocols and are subject to higher scrutiny for their offset quality.

Voluntary markets

As more industries (not subject to emission caps) make net zero carbon emission pledges, demand for carbon offsets will increase. To address the increase in demand for carbon offset projects, several voluntary markets have been launched to fill that need. These programs are run by the private sector and individuals or companies pay project developers to implement activities that result in emission reduction or CDR. The much smaller voluntary markets allow individuals, small and medium-sized businesses, and even large corporations not under a compliance program to offset their emissions. Although offset credits traded on these markets also need to be of high quality, there is more flexibility in the protocols used for carbon accounting.

Quality

Carbon offset quality similar to other terms in this nascent market is loosely defined. Although different references define offset quality differently, they all use terms such as the ones listed and explained below:

Additionality

A carbon reduction or offset needs to be additional in order to be deemed viable. That means the process that removes carbon should happen in addition to an entity's business as usual operation. In other words, the entity generating the offset should go above and beyond what would have happened in a no-intervention baseline scenario. In policy regimes such as cap-and-trade programs, where emissions are permitted in exchange for reduction or storage elsewhere, failures of additionality result in increased emissions.

Permanence (or Durability)

For carbon offsets to be deemed viable, they need to guarantee that the atmospheric CDR is permanent (usually defined as 100 years, although many buyers are now seeking permanence of 1000 years or more). However, many nature-based solutions have lower permanence than 100 years. New methods such as Time Adjusted Global Warming Potential have been developed to address that issue.

Verifiable

An independent and qualified third party has conducted a detailed review of all aspects of the carbon project and attests to the emission reduction claim.

Registered

Carbon credits are unique, serialized, tracked, and can be retired only once.

Real and Enforceable

The credits created through the project must be accounted for and traceable. The credits usually exist in a registry and are retired once sold.

Reversal (or Leakage)

Reversal refers to the CO2 that is released back into the atmosphere from a CDR project. Examples include tilling land that was supposed to remain no-till, forest fires, and CO2 leakage from an underground reservoir. Project developers should keep reversal in mind and create a buffer for reversal or leakage that might result after the project is implemented. Measuring potential reversal over time is an important part of any CDR project (see 'MRV' below).

Measurement, Reporting, and Verification

Measurement, Reporting, Verification (MRV) is the most important step for a successful carbon reduction or removal project. A robust MRV guarantees that offsets are of high quality and that the project developer is being compensated for the true volume of carbon sequestered and if any reversal happens, they are accounted for.

Carbon [Offset] Credit or Certificate

Carbon credits or certificates are the tradable instruments that are sold on either compliance or voluntary markets. Carbon credits are always measured in the unit of 1 metric ton of carbon dioxide equivalent. One carbon credit is a unique, independently verified reduction of greenhouse gases traceable to the carbon project that generated the emission reduction. A carbon credit once generated can be traded and then retired by the respective entity. Retiring a credit ensures that carbon offsets are not double counted and can only be traded once.

Registry or Standard

Standards and Registries are often used interchangeably. What they typically refer to are carbon certification programs. These programs use different carbon accounting methodologies called protocols. The goal of using these carbon accounting methodologies is to have a transparent and legitimate way of estimating how much carbon has been removed. Once the offset projects are certified they are then displayed in a database called a Registry. Registries are important because they provide a way to have traceability, uniqueness, and transparency.

There are several registries in the compliance and voluntary offset market, which have been developed by governments, non-profits, and the private sector. Main carbon registries for both compliance and voluntary markets are:

American Carbon Registry (ACR)

APX Inc., which administers the following offset registries:

Climate Action Reserve (CAR)

Markit, which administers the following offset registries:

Verra, which administers the following offset registries:

Verified Carbon Standard (VCS)

Protocols

Protocols are pre-approved methodologies for CDR projects. Project proponents should ensure the methodology’s applicability conditions are appropriate to the project location, activities, technologies, and other specific circumstances. Not all CDR projects have a protocol readily available. Leading protocol development organizations have a stringent process for developing and approving a new protocol which could take years. Main registries such as ACR, Gold Standard, CAR, Puro earth and Verra are also the leading protocol development organizations.

Carba’s Approach

Carba offers low energy natural biomass torrefaction conversion (graphitic carbon) with removal and permanent storage. The product benefits are high-value, durable, permanent, scalable, uses no water, have low energy consumption, and uses natural regenerative biomass feedstock. Carba's B2B marketplace platform partner(s) verify the net-negative certificates and offtake agreements for CO2 removal certificates and pre-CO2 removal certificate i.e.) futures.

The Carba team launched with a mobile reactor (1t/day) in 2022 for biomass feedstock testing of woody biomass, nutshells, and other natural biomass feedstocks. The stable carbon generated is then sequestered underground for thousands of years as will the carbon removed through other Carba reactors in the United States and ultimately around the world. Carba has multiple large sale reactors in design for delivery in early 2023. These at scale reactors will process larger volumes of biomass for conversion to a inert solid carbon.

-- SOURCES: Contributing author: Arian Aghajanzadeh, Klimate Consulting LLC

Figure 4: An artist rendition of carbon removal technologies (Source: National Academies of Sciences, 2019)